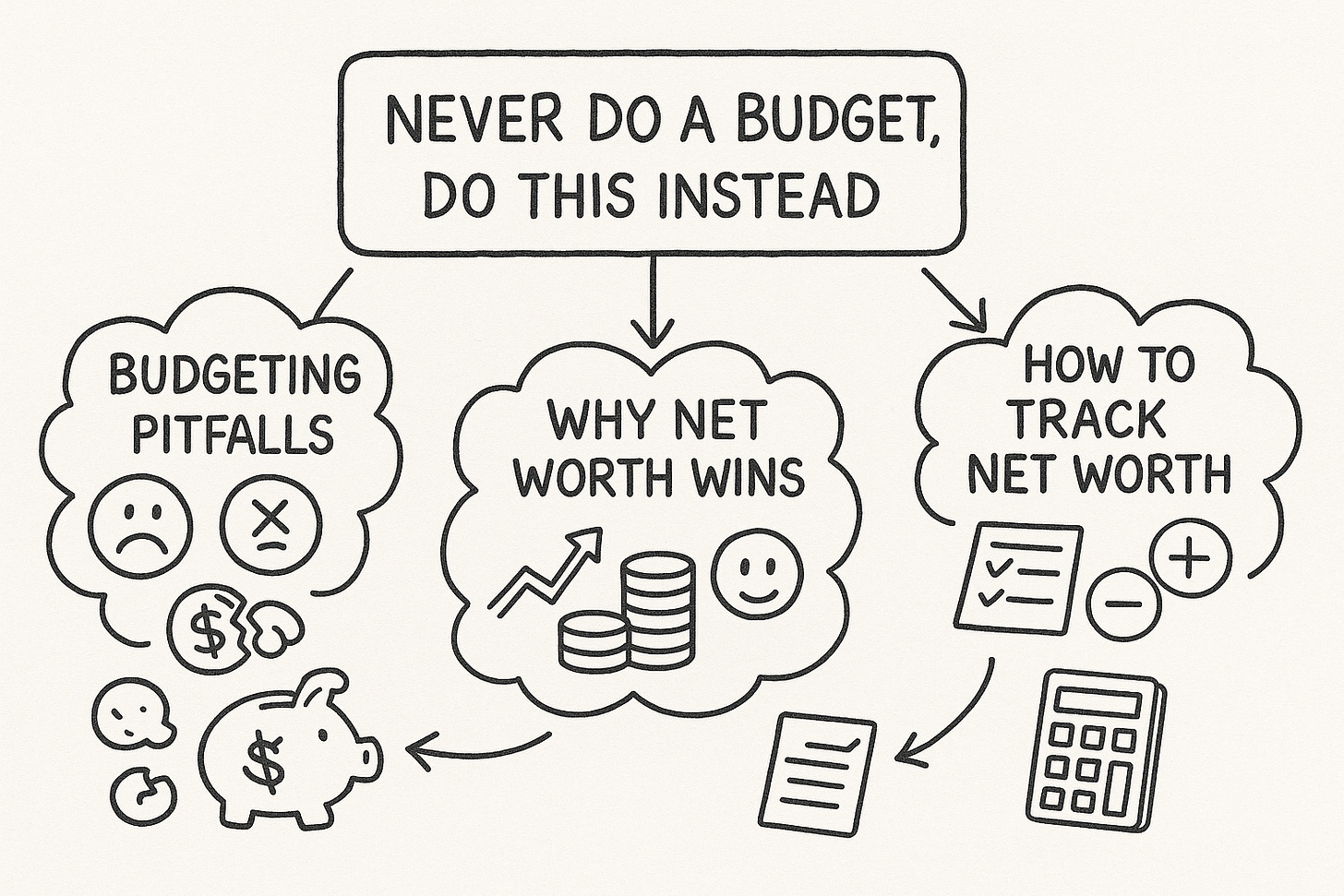

Let’s get this out of the way: budgeting is overrated.

Yes, I said it.

Tracking every dollar you spend each day is a lot like counting every calorie you eat — it can be helpful sometimes, but it’s exhausting, unsustainable, and often misses the point. You don’t get rich by obsessing over your coffee habit. You get rich by building assets and monitoring your net worth like your life depends on it — because financially, it kind of does.

Here’s why you should stop obsessing over budgets and start tracking your net worth instead.

The Budget Trap

Budgets tell you how much you think you’ll spend. Net worth tells you what you actually have.

Most people create budgets with good intentions — to gain control, reduce spending, and get a clearer picture of their finances. But over time, budgeting can devolve into an exhausting ritual that feels like a failure every time you go off-script. Spent too much on groceries this month? Budget blown. Unexpected car repair? Budget destroyed.

But none of that actually tells you how you're doing financially.

You can budget perfectly and still be broke. You can overspend every month and still be building wealth — if your net worth is increasing.

What Is Net Worth and Why It Matters

Net worth is the single number that cuts through all the noise. It’s the true scoreboard of your financial life.

Net Worth = (Everything You Own) – (Everything You Owe)

That’s:

The value of your savings, checking, and investment accounts

The market value of your home (if you own it)

Any other assets (car, business equity, crypto, collectibles — if they’re meaningful)

Minus:

Credit card debt

Student loans

Mortgage balance

Any other liabilities

Net worth shows whether you’re moving in the right direction or not. That’s why people in the FIRE movement live and die by it. Your income, spending, and savings rate only matter insofar as they move your net worth up.

How to Track Your Net Worth

Forget the daily expense tracking. Do this once a month — it takes 10 minutes and tells you everything you need to know:

List all your assets: Check your bank accounts, brokerage accounts, retirement accounts, and home value (use Zillow or Redfin estimates if needed).

List all your debts: Credit cards, car loans, student loans, mortgage, etc.

Subtract your liabilities from your assets.

Track the number month-to-month. Use a spreadsheet, an app like Monarch or Empower, or even a notebook.

Watching your net worth go up month after month is not just motivating — it’s life-changing. It forces long-term thinking, encourages better decisions, and keeps your focus on the big picture.

Why Budgets Don’t Build Wealth (But Net Worth Does)

Budgets focus on control. Net worth focuses on growth.

Budgets can help rein in spending — and that’s not a bad thing. However, they often don’t lead to better investing, more effective debt repayment, or more intelligent asset allocation. They track how you feel about money, not how you’re doing.

On the other hand, watching your net worth forces you to:

Increase income (to save/invest more)

Avoid bad debt (because it drags down the number)

Invest (because cash sitting still isn’t enough)

Think long-term (because wealth takes time)

The FIRE Mindset

In the FIRE community, we don’t track every latte. We track our freedom number — the net worth number that means we never have to work again.

You can’t budget your way to financial independence. You invest your way there. You build there. You measure progress with your net worth, not your grocery line item.

So stop budgeting. Start tracking your financial life with the number that actually matters.

TL;DR

Budgets are restrictive, net worth is revealing

Net worth = assets – liabilities

Track it monthly, and watch the story of your financial life unfold

You don’t need to count every dollar, you need to grow your wealth

FIRE isn’t about discipline — it’s about direction