No One Actually Cares About Your Car

So Why Are You Paying $900 a Month?

There’s a strange thing you can see when driving (pun intended) around the very sprawling beige subdivisions that go on forever into the horizon. It takes the form of a drive packed with a set of vehicles that probably add up to at least 1/3 to 1/2 of the value of the house in front of which these money drains sit.

Stange.

It seems to be a widespread plague that haunts about every echelon of our society. The Orwellian marketers have done their job well. You can’t watch a TV show, sit in a movie theatre, or drive down your street without that subconscious message being poured down your throat.

Lovely car = Status Symbol.

Seems to be on par with credit card and student loan payments, in terms of the “normality” of it. I can’t think of a single thing more likely to keep people solidly middle-class and broke than a car payment.

And big car payments at that.

Vehicle debt stats.

Even the Reddit rabble is starting to ask questions, which tells you something.

And it gets even better. Have you checked on the average car payment lately? I mean, it seems like it would be cheaper to do drugs ( don’t do drugs ). $748 a flipping month??!!

All the while, people can’t save, and apparently have no money. Oh, because “the economy and inflation are bad.” Flipping idiots.

I mean, people have no idea what they are doing when they sign up for a car payment. I really don’t think they do. They are not only destroying their current self, but more importantly, their future self has also been sacrificed in a way that CANNOT be undone.

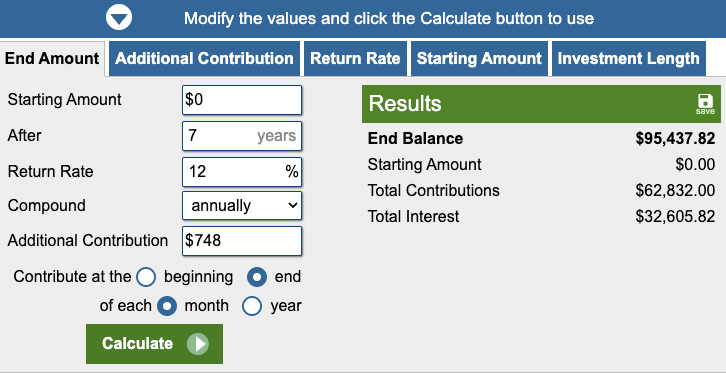

Starting from zero, $748 a month, over seven years. $100gs, just like that. Gone, forever, over a lifetime, it’s actually quite insane. Most people have car payments for their entire young and middle adult life.

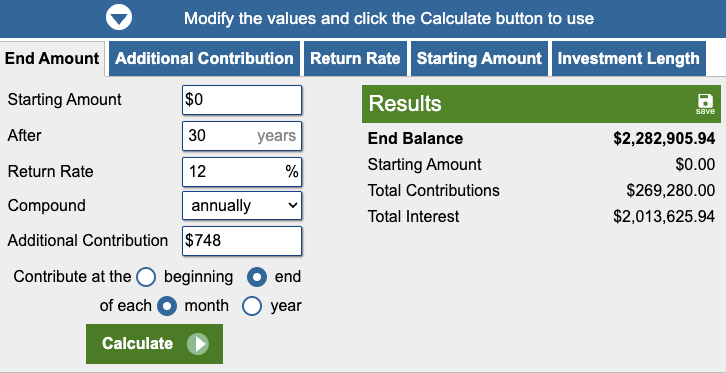

Thirty years of car payments add up to 2.2 million, you can never get back, ever.

We buy cars—expensive cars—not because we need them, but because we think other people will admire them. Yet here’s the uncomfortable truth:

Nobody is watching you pull into the grocery store parking lot. Nobody cares what emblem sits on your grille. You think people are watching and care about you. Newsflash … people are obsessed with themselves; they aren’t paying attention to you.

People are too busy worrying about their own lives, bills, kids, and Netflix shows to think about your vehicle for more than 0.4 seconds. But your car payment? That cares about you a lot.

It cares enough to follow you home every month.

It cares enough to siphon money away from your investments.

It cares enough to delay your financial independence for years.

Let’s dig into what’s happening—and why car payments have quietly become one of the biggest wealth killers in America.

🚗 The Average Car Payment Is Now Financially Absurd

Here are the numbers from the latest 2024–2025 auto finance data:

Monthly Payments

Average new car payment: $766 per month

Average used car payment: $532 per month

Payment for “super-prime” borrowers: over $900/month for popular SUVs and trucks

EV average payment: $861/month

These aren’t luxury buyers. These are everyday Americans signing up for a second mortgage on wheels. Literally, unless you are already a millionaire (and can drive whatever you want), investing massive amounts of money in things that are going down in value is the opposite of smart.

It is crazy, I don’t care what you say. Even if you are well into the upper middle class, like me, and can “afford” to drive whatever you want, don’t be an idiot. It’s money you will never get back, ever. Pay cash and get something middle-range.

Loan Terms

I mean, I thought I was reading some Onion News or something when I started reading about the new loan terms. Talk about an American dystopia. All those idiots driving jacked-up 2500HD trucks 10 miles to work and back.

Average loan term: 68.6 months

1 out of 5 new car loans: 84 months (7 years)

Average new auto loan amount: $40,366

These numbers are wild.

An asset that loses 15% of its value the moment you drive it off the lot… financed for seven years. It’s going to be near impossible for most folks making these sorts of poor vehicle decisions to end up anywhere good in the future. Sure, a few manage, but most won’t.

The same people willing to make two car payments of $ 1,500 a month aren’t usually the ones willing to put money into an emergency fund, a college fund, or a 401 (k). These are two very different sets of people.

💸 Interest Rates Have Exploded

We haven’t even got to the interest rates yet, yikes. Not only are people willing to commit financial stupidity at absurd rates, but they will also actually PAY the bank even more for the opportunity to be a moron, compounding (pun intended) stupidity with more stupidity.

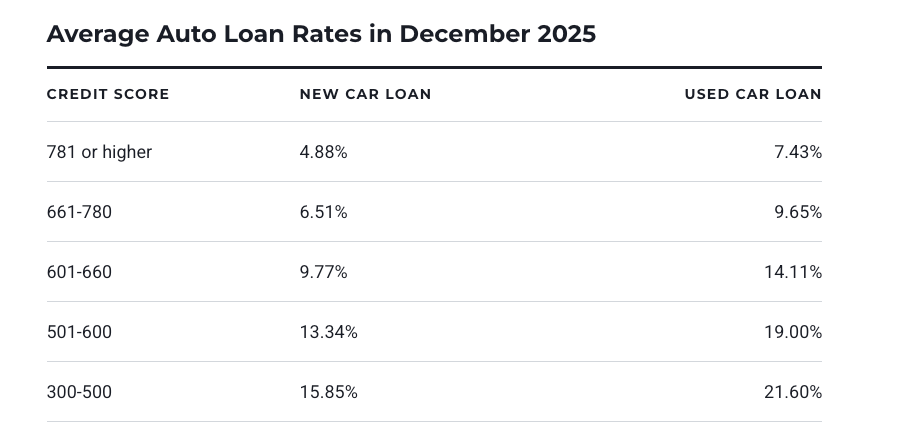

Auto loan interest rates are at their highest levels in 20+ years:

Average new car rate: 7.4%

Average used car rate: 11.5%

Subprime used rates: 17–28%+

If I had a big !@#$ car loan with that kind of interest rate sitting in my garage, I’m not sure I could even sleep at night. I would have heart palpitations every time I got into the driver's seat.

How did we end up in a culture where this sort of thing is normalized? In a culture where youth aren’t taught the tiniest thing about personal finance and the dangers of debt, let alone debt on assets that go down in value. Insane. Thanks, Instagram.

🔥 Car Loan Delinquencies Are Quietly Surging

A recession isn’t here, but car loan stress is. Doesn’t take rocket science to figure this one out. The same people are buried under student loans, credit card debt, and mortgage payments that are too high. Can’t afford that car? Surprise, surprise.

Key delinquency stats:

90-day auto loan delinquencies are at their highest level since 2009.

Severe delinquency among 18–29-year-olds: now over 9%.

Repossession rates have jumped by more than 20% since 2020.

Why? Americans are treating cars like status symbols instead of transportation tools. And the lenders know it.

🧠 Why We Overspend on Cars (The Psychology Part)

We have to admit something and be honest about the culture we live in. It’s not like people don’t know how to run a calculator. It’s an educated, probably overeducated society these days. How can smart people be so dumb?

Clearly, it’s something happening in another part of the brain.

Visibility Bias

A car is one of the few expensive things you own that other people actually see. So your brain thinks it matters more than your index fund balance.

Comparison Effect

You see your coworker’s new truck. Your brain says: “We make about the same… so I deserve that too.”

Identity Signaling

People equate cars with success. Even though the people with the highest net worth often drive Toyota, Honda, and Subaru.

(The average millionaire drives a 4–to 6-year-old used car. Really.)

Easy Financing

Dealers don’t sell cars. They sell monthly payments.

“Only $899/month!” feels reasonable… even though the total cost is insane. Hey, don’t get me wrong, I LOVE CARS. I rebuilt classic cars in high school; I’m a car guy. I love big trucks and fast cars, part of being a man.

I drive a nice Jeep Gladiator that gives me joy. The difference? I waited longer than most people and paid cash for it. Now I have a nice car, and my car doesn’t have me.

🕛 Nobody Will Remember What You Drive

Here’s the big lesson: when you are dead and gone and buried in the ground, which is going to happen (deal with it), no one will remember or care what you drove around. It’s just an insignificant part of life that gets blown out of proportion in our minds.

Your friends don’t remember your car.

Your neighbors don’t care about your car.

Most people don’t even notice your car.

But your future self will absolutely notice:

The $75k you gave away to depreciation and interest

the extra 3–5 years you have to work

The stress you carried because your payment was too high

If you want to accelerate your path to financial independence, here’s the truth:

**Drive a cheap car or something you paid cash for.

Invest the difference. Buy your freedom, not your status. Because nobody is keeping score… except your net worth. Don’t be a fool, be money smart. Get a nice, reasonable car, pay cash for it, and be free. Invest your money elsewhere.

They get you in the moment with the proverbial shiny object. Granted, there is an argument to be made for buying a new car, then driving it into the ground. That's my plan with the current car - but that's always the plan, for everyone, right?

I will be thinking long and hard about my next car purchase.