💰 Pay Yourself First

“Do not save what is left after spending, but spend what is left after saving.” — Warren Buffett

One of the simplest, most powerful FIRE habits I’ve ever adopted is this: Pay Yourself First.

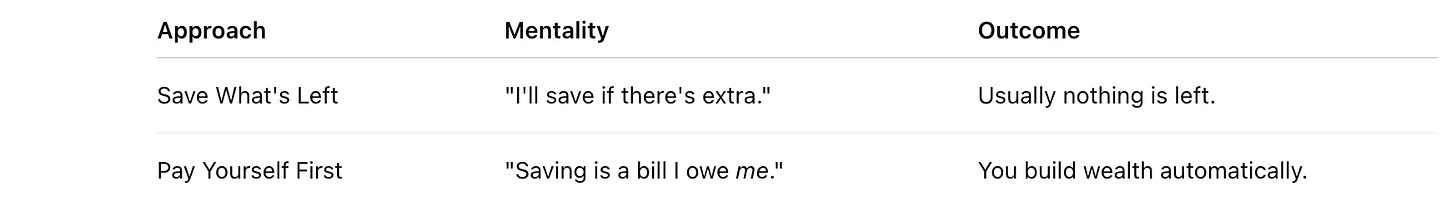

Sounds obvious, right? But it’s one of those "simple-not-easy" ideas that changes everything when you actually do it consistently. Most people save after they spend. FIRE folks do the opposite. We save, invest, and then let spending trickle in.

This is probably one of the single largest differences between the average person walking around a grocery store and you, in all your FIRE glory. When you have a list of expenses, your name is at the very top!!

This was probably one of the most challenging things I learned when I first started showing interest in personal finance and investing. It’s a challenging mindset shift to make when we grow up being taught everything except how to manage our finances.

You ARE going to have a long list of expenses every single month.

gas

grocery

mortgage or rent

blah, blah, blah

There is simply no way to escape it. What is a radical shift to make in our culture of paycheck-to-paycheck? Take your own name and put it at the top of the list.

Pay yourself first.

🔁 The Old Way vs. The FIRE Way

💡 How It Works

Every time money hits your account:

Skim off your goals first – 401(k), IRA, brokerage, HSA, sinking funds.

Automate it – Treat it like rent. It’s non-negotiable.

Live on what’s left – You’ll adjust to the budget. Humans adapt fast.

It’s budgeting in reverse. It’s the cornerstone of FIRE.

You are either going to pay yourself first or not, it’s not that much about the money, although it is, it’s more about the mindset shift the leads to long term changes that pay dividends … literally.

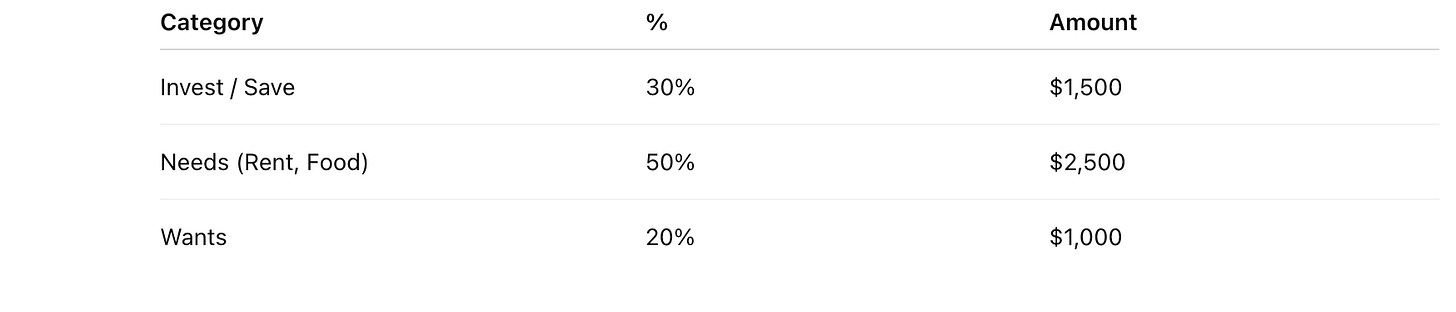

📊 Visual: A Simple Example

Let’s say you make $5,000/month after taxes.

You "pay yourself" that $1,500 first—before rent, before anything. That’s your ticket to freedom.

🔧 Tools to Help You Do This

🏦 Automatic Transfers (Bank → Roth IRA or HYSA)

📈 401(k) Auto-Contributions

💵 Paycheck Splits (Direct deposit into multiple accounts)

📅 Recurring Investments (With M1, Vanguard, or Fidelity)

Personally, I have found the automatic transfers to be the most useful here. Sure, there are a few brave people who can just wing it and say “I will put $1000 in my brokerage account at the end of the month.” But, that is not most of us.

Putting it on auto-pilot is the answer.

🚀 Why It Works

Paying yourself first is a behavioral hack. It removes temptation and mental negotiation. It makes wealth inevitable instead of optional.

The real secret? Once you start doing this, your spending naturally aligns with your values. You stop asking “can I afford it?” and start asking “do I even care about it?”

🔚 Final Thought

“Pay Yourself First” isn’t just a trick for saving money—it’s a philosophy. It says, I value my freedom more than my impulse buys. It says, I am investing in Future Me.

And Future You? They’ll be incredibly grateful.

🔥 What % of your income are you paying yourself first right now? Let me know in the comments. Let’s grow together.