I recently had the pleasure of updating my budget while sitting in the hot, boring school pickup line. The truth is sometimes life throws curve balls at us, and even FIRE folk have “bad” budget months. I had one … and the month is not even over yet. Uh oh.

There is a reason I put “bad” in quotes; I suppose that is somewhat subjective and different based on the person. If someone is still paying off large amounts of debt and living that classic paycheck-to-paycheck life, “bad” budget months probably have a whole different meaning.

Yet, we all know the straight, narrow road to financial success is strewn with potholes and steep ditches. No one is immune.

Most likely we shouldn't be surprised when we have “bad months,” but instead we should be realistic about living life and being good financial stewards. We should be prepared.

Accept the fact that expensive months happen.

Save healthy amounts of cash so it doesn't matter.

Do a budget regularly so you know what's happening.

Adjust accordingly to course correct.

Keeping these ideals alive and well in life is key the having long-term financial stability.

Lulled into security

For me it's easy to fall into the soft and serene cycle of investing, saving, and simply going about life without much thought about my overall monthly budget. I'm in the habit of updating my budget either once a week, or maybe once every two weeks if life is crazy.

I track every red cent that leaves my account, but I don't typically agonize over every dollar. Life’s to short for that kind of living.

What does that mean? I simply glance at categories like gas, groceries, spending, etc, and based on years of experience instantly know if things are on track. All it takes is one look and I know exactly what has been happening. Well, my April was “bad” when I sat in my hot car in that school pickup line.

I mean there's always a reason isn't there? Big doctor's bills. Elevated spending. You know … life.

Revenge.

It's true, your human, revenge is a sweet, nothing sweeter. That's probably the biggest lesson I've taken from bad budget months, like this one. The first step is knowing what is happening with your money and recognizing things have gotten off track.

Check.

Look closely at what happened and what went wrong.

Check.

Make a plan to course correct and get things under control.

Check.

Get your revenge the next month.

…

For some people it might simply be actually keeping a budget.

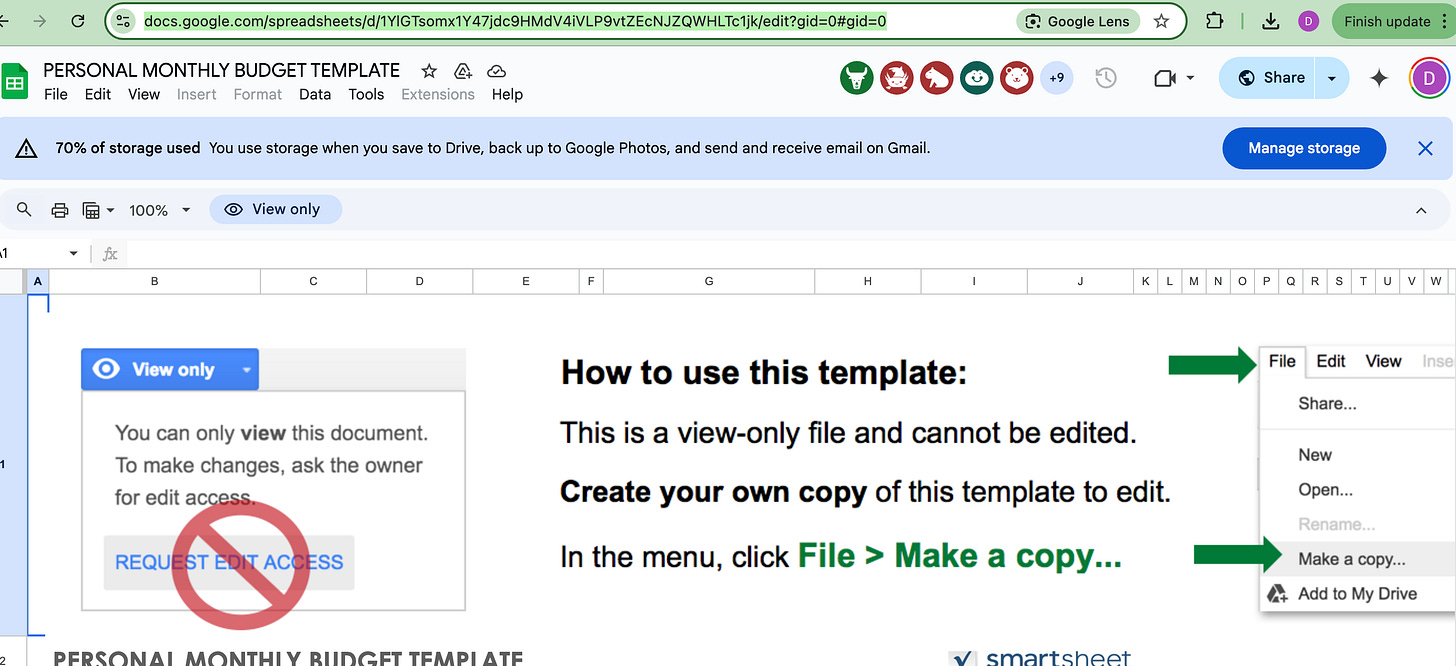

I personally use Google Sheets and EveryDollar. Bet you didn’t know Google Sheets has personal budget templates.

You will never know if you’re having a bad money month if you don’t track your spending one way or the other. Gotta do it.

The perfect budget this the way to get revenge on a bad budget month, show that money who’s boss. They key is not have too many of those bad month’s, tighten the reigns, turn that ship around.